What is property tax depreciation?

Buildings and their contents that are used for income producing purposes are eligible to be depreciated. Similar to capital assets owned and used for income producing purposes, such as machinery, which can be depreciated over time.

The Australian Taxation Office (ATO) allows owners of income producing properties to claim this depreciation as a deduction. Unlike other deductions, such as interest on a loan where you need to outlay money in order to make a claim, depreciation is considered a non-cash tax deduction.

All types of income producing properties have substantial taxation benefits. Both new and old properties will attract some depreciation benefit that the investor is able to claim to reduce their tax liability. A common myth is that older properties will attract no claim – which is not true. It is worth making an enquiry about any property, regardless of its age.

When an investor hasn’t been claiming deductions for tax depreciation, previous financial years’ tax returns can be amended. The ATO allows for the previous two years returns to be amended, and in some instances the ATO may have to pay you money back.

What is in a depreciation schedule?

To ensure every investor’s claim is maximised, BMT utilise a comprehensive depreciation schedule. For eighteen years BMT have continually refined the reporting process and system to offer a report second to none.

Below is a list of what to expect in a BMT Tax Depreciation Schedule:

- A glossary of terms simplifies the terminology used for easy understanding.

- A one page overview explains the total deductions for each depreciation method.

- Both prime cost and diminishing value method deductions are shown for plant and equipment assets.

- A forty year projection shows all of the deductions available for the life of the property.

- Low-value and low-cost pooling are used to accelerate deductions.

- The effective life of each asset is displayed and a total shown for the division 40 effective life and pooled assets.

- A pro-rata calculation will be used when a property is acquired part way through a financial year or rented for only a percentage of the year.

- Percentage based grouping of assets shows a calculation of all assets depreciated at the same percentage rate grouped and totalled.

- Split reports are available when a property is owned by more than one person, resulting in higher deductions earlier.

- Excel and CSV formats are provided to Accountants for easy use with software

The key points to remember are:

- As a property gets older the building and the items within it wear out, put simply, they depreciate in value. The ATO allows property investors to claim a deduction relating to this.

- To enable the maximisation of a tax depreciation claim, investors need to engage a specialist to complete the inspection and schedule. The ATO only allows for a few professions such as Quantity Surveyors to complete these reports.

THE DEPRECIATION DEDUCTIONS THAT OFTEN GO UNCLAIMED

Depreciation continues to be one of the most common deductions missed as research suggests that just 20 per cent of property investors maximise the deductions they can claim.

On average, an income producing property owner can expect to claim between $5,000 and $10,000 in depreciation deductions in the first financial year alone. These deductions play a vital role in helping property investors to improve their available cash flow and reduce the costs of holding a property.

With such high numbers failing to maximise depreciation, investors often ask what items are most often missed or are rarely claimed to avoid missing out on deductions in the future.

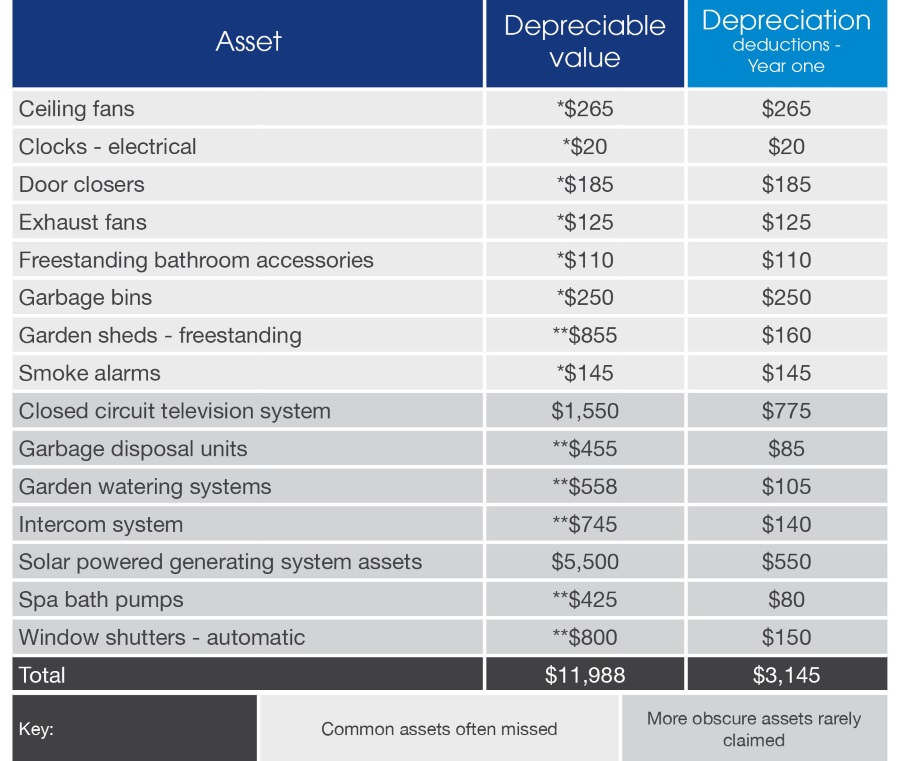

To assist investors, BMT Tax Depreciation compiled a list of the common assets missed and more obscure assets rarely claimed, as shown below.

The depreciation deductions within this table have been based on the diminishing value method of depreciation and are based on a first full financial year’s claim. *Assets which have a depreciation value of $300 or less can be written off as an immediate write-off in the first full financial year’s claim. **Those assets which have a value of $1,000 or less can be added to a low-value pool and depreciated at a rate of 18.75 per cent in the first year.

As the table shows, ceiling fans, door closers, garbage bins, smoke alarms and freestanding garden sheds are some of the assets commonly missed by property investors.

More obscure and less frequently found items that are rarely claimed included closed circuit television systems (CCTV), intercom systems, garden watering systems and spa bath pumps.

While many of the items in the table have a low depreciable value, the depreciation deductions for these items can add up to thousands of dollars for an investor.

To ensure that depreciation is maximised, it is recommended that investors seek advice and obtain a tax depreciation schedule from a specialist Quantity Surveyor. This will include a detailed site inspection of the property to photograph and note every depreciable asset found in the property. The Quantity Surveyor will then use their expert knowledge of depreciation and utilise methods such as immediate write-offs and low-value pooling to maximise the deductions that can be claimed for the investment property owner.

All of the deductions a property investor is eligible to claim will be outlined in a comprehensive depreciation schedule in a format that they or their Accountant can easily follow and claim the depreciation benefits when they complete their annual income tax return.